The City of Boston annually requests that Boston-area nonprofits make voluntary payments as a result of their tax-exempt status.

In light of a recent report released by The Boston Globe, some of the largest educational nonprofit institutions across Boston, including Boston College, are opting not to submit these voluntary payments, which the city uses to fund municipality services.

The voluntary payments in lieu of taxes (PILOTs) are recommended by City Hall through the relatively recent PILOT program—an initiative formed in 2011 under then-mayor of Boston Thomas M. Menino seeking contributions from Boston-area nonprofits that own more than $15 million in tax-exempt property.

The payments sought by the city would cover services such as snow removal, police protection, trash disposal, and fire department services, among other costs funded by taxpayer dollars, which would otherwise be accrued through private sector institutions in place of the nonprofits, the report stipulates.

Although city officials had privately met with nonprofits in search of voluntary payments for decades, the Menino administration aimed to structure the payment process into a formalized annual request, the Globe reported.

By fiscal year 2016, the PILOT program is slated to increase the recommended donations to 25 percent of the property tax a nonprofit would owe if non-exempt.

According to the findings compiled by the Globe, BC, among other Boston-area colleges and universities, declined to pay the requested amount, while most hospitals met the fully suggested amounts.

This year, the City of Boston calculated that 25 percent of taxes made on BC’s property would be valued at $2,300,056. According to the PILOT Task Force webpage, institutions are eligible to pay up to half of the calculated property tax value in “community benefits credit”—a monetary estimation of the services produced by the nonprofit to the city.

According to the Globe report, BC’s community benefit credits were valued at $1,150,028—the maximum allowable credit. Of the remaining $1,150,028 in suggested contributions, the University paid $317,888 for municipalities outside of the PILOT program, the report shows.

The University’s dismissal of the calculated PILOT amount is, in part, due to it not receiving the municipal services the city cites as grounds for the suggested payment, said University Spokesman Jack Dunn.

“This year, Boston College paid the City of Boston $317,887 and the City of Newton $123,212 in payments for municipal services for the one service we receive—fire protection service,” Dunn said. “The University has been making these payments for municipal services since the early 1990s, based on agreements established by Boston and Newton.”

Those payments, though, are made independently of the PILOT program, as the University holds that it typically only pays for services external to the institution itself, such as fire department services. Snow removal services, a police department, and trash disposal are all coordinates internally by the University without direct city assistance.

While the Globe’s findings do not include the percentage of total property occupied by nonprofits, the costliest institution was Boston University, which the city asked pay $13,068,735 as part of the estimated 25 percent of the property tax it would generate if not tax exempt. The university qualified for half of the roughly $13 million in community benefit credits, and it paid approximately 92 percent of the remaining recommended amount, according to the Globe.

Dunn stated that instead of fulfilling the requested payments, BC chooses to allocate funds directly to neighborhood programs and local school organizations. He said that direct contributions to those organizations would likely have a more direct and immediate impact.

“As a Jesuit, Catholic University that is committed to service and volunteer outreach, we feel that the best way we can assist the City of Boston is through the more than $30 million in community benefits that we provide to the City and its residents each year through scholarships, jobs, volunteer outreach, community grants, and the public and private funding we procure for Boston’s public and parochial schools,” he said.

“Boston’s PILOT program is voluntary,” Dunn continued. “As a nonprofit educational institution and a religious affiliate, we choose not to participate in the PILOT program so as not to forego our nonprofit status.”

According to the PILOT Task Force, the city received an overall $24.9 million of the $34.6 million requested, or about 71.8 percent of the suggested payments. The number of nonprofits solicited by the program totaled 49, up from 45 during the program’s first fiscal year in 2012. According to the Globe, the combined value of the 49 institutions’ annual property taxes would total about $425 million if not for their tax-exempt status.

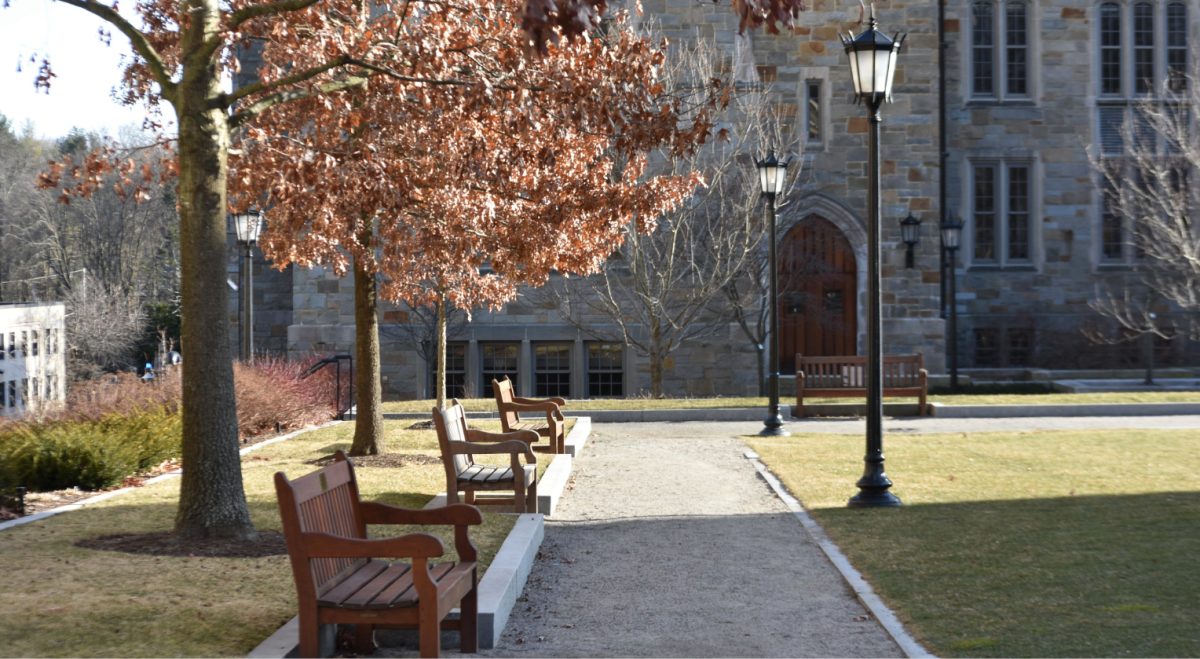

Featured Image by Daniel Lee / Heights Senior Staff