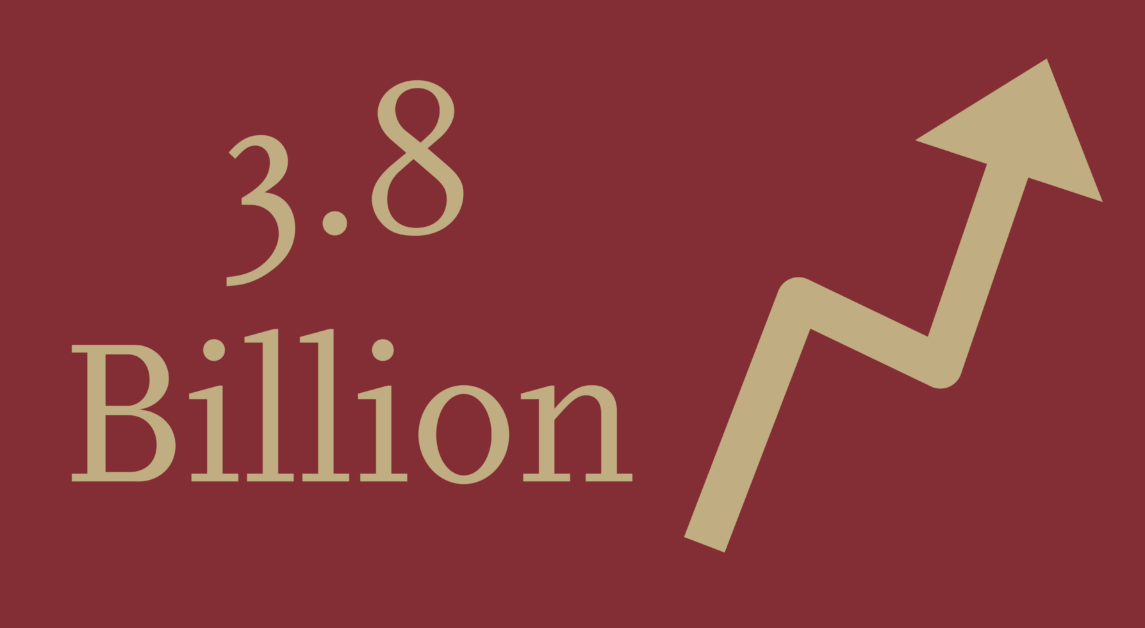

Boston College’s endowment grew by almost $1.2 billion—or 46 percent—to reach a total of $3.8 billion in the past fiscal year. The large gains reflect significant returns on BC’s investments, according to the Boston Business Journal.

In a statement to The Heights, University Spokesman Jack Dunn attributed the endowment increase to the work of a variety of BC staff and committees.

“Boston College’s return on its endowment during the past year, ending June 30th, was 46.4%, which is attributable to excellent leadership by the Investment and Endowment Committee of the Boston College Board of Trustees and BC’s Chief Investment Officer John Zona,” Dunn wrote.

BC’s gains in the past year—from June 2020 to June 2021—are 19 percent higher than the median endowment gains for colleges in the United States, which were 27 percent, according to Bloomberg.

“The investment results, on top of an infusion of federal stimulus funds, are a welcome financial balm for schools that have grappled with revenue declines as the pandemic curtailed enrollment,” the article reads.

The University’s 2020–21 Financial Statement Summary cited unprecedented net asset growth, and also emphasized the endowment increase and federal funds the University received during COVID-19.

“The financial statements also reflect a historic endowment return contributing in excess of $1.1 billion to the University’s balance sheet as well as government support provided through the CARES Act, used for student aid and University support to off-set COVID-19 related expenses and lost revenue,” the statement reads.

Despite these drastic updates to many colleges’—including BC’s—endowments, many colleges won’t be likely to update their budgets in the upcoming year, according to Bloomberg.

“Still, the one-year gains may not have much of an impact on university budgets,” the article reads. “That’s because spending plans are typically determined by longer-term average investment returns of three to five years.”

Featured Graphic by Olivia Charbonneau / Heights Editor