Goldman Sachs and JPMorgan Chase won’t participate in business school recruiting of college sophomores this year, according to a Wall Street Journal report.

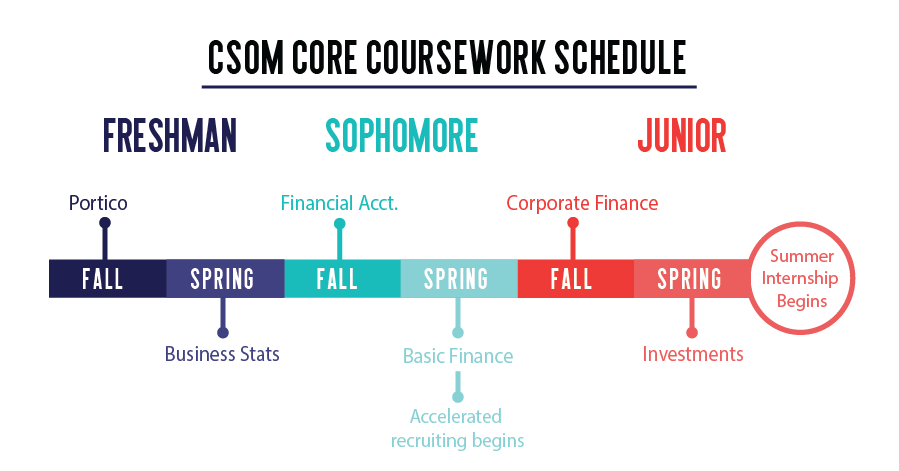

Beginning this past year, recruiting opened during the spring semester for sophomores to try to get an internship in the summer of 2019—over a year after they’re initially recruited. The WSJ report indicated that two years ago, recruiting began in the fall of junior year for the first time. A year later, recruiting began creeping into the spring of sophomore year.

“We applaud what Goldman Sachs and JPMorgan are doing and hope others follow suit,” Joseph Du Pont, associate vice president for Student Affairs and Career Services, said in an email. “We are working with [the Carroll School of Management] and peer schools to encourage other banks to follow their lead and reconsider super early recruiting deadlines.”

Du Pont and Amy Donegan, assistant dean for undergraduate career advising in CSOM, have been working to communicate with not only peer institutions, but also with banks who participate in recruiting—previous Heights reporting has identified Barclays, UBS, CITI, and Bank of America as banks with traditionally large presences on campus during recruiting.

“It doesn’t benefit anyone when students feel forced to accept an offer before they have had a chance to prepare and fully explore their options,” Du Pont said. “That’s what’s happening here.”

Despite that sentiment, both Donegan and Du Pont stressed that they are aware of the responsibility of BC to ensure that the University offers its students the best chance at a job after graduation—that means that if banks force an early recruiting timeline, exactly how the University would push back against those measures would require extensive consideration.

Only the University of Pennsylvania has made a definitive decision not to allow recruiting during sophomore year, according to Donegan. She noted that no decision has been made as to what the best move is for the University—she, as well as the Career Center, will be talking with students as well as the banks and peer institutions about what they believe is the best move going forward.

“It’s very complicated, because you always want to balance advocating for the students without hurting the students by trying to over-advocate and having firms go away,” Donegan said.

Recruiting has also put strains on the University in other areas, notably affecting how CSOM students and other students interested in jobs in the business world make their study abroad decisions, which has led to the Office of International Programs reconfiguring study abroad requirements due to extra housing pressure during the fall—when recruiting has taken place in the past.

Donegan said that she talked to CITI, which is currently undecided on whether it will follow in Goldman and JPMorgan’s footsteps on this issue. It’s too early in the process for Donegan to detect whether the trend, which has previously meant that banks would recruit earlier and earlier in order to gain an edge over other firms, has been reversed, she said.

That edge may not have worked in the banks’ favor, according to Donegan. Though she hasn’t received anything beyond anecdotal evidence backing this up, Donegan noted that by recruiting so early in students’ academic careers, the banks’ yield on hires may be suffering. It’s important to those businesses that when they make a hire, potential employees stay committed to the company that hires them. Given that so much changes between second semester sophomore year and graduation for students, this process may be hurting firms’ yield.

“I think that anybody who’s involved in this process on the side of the banks realize that it’s kind of silly,” Donegan said. “My hope is that they realize [this] was giving them less criteria to work with to make selections.”

She also pointed out that some universities don’t even have four-year business programs that firms still recruit from—so firms may be recruiting students who aren’t even business students yet due to the current recruiting timeline. Regardless of the length of a university’s business program, students across the board have received the bare minimum in terms of finance education when recruiting begins, according to Donegan. Students have taken financial accounting and may be “halfway through Basic Finance” by the time recruiting begins.

Since students are being recruited for internships that begin over a year from when recruiting takes place, that means that they will learn an entire year’s worth of business classes between recruiting and actually beginning their internship. That strains students during the interview process, according to Donegan, since they have to “fake” how much they know in order to live up to firm criteria—a phenomenon that also hurts recruiters.

Featured Graphic by Madison Mariani / Graphics Editor