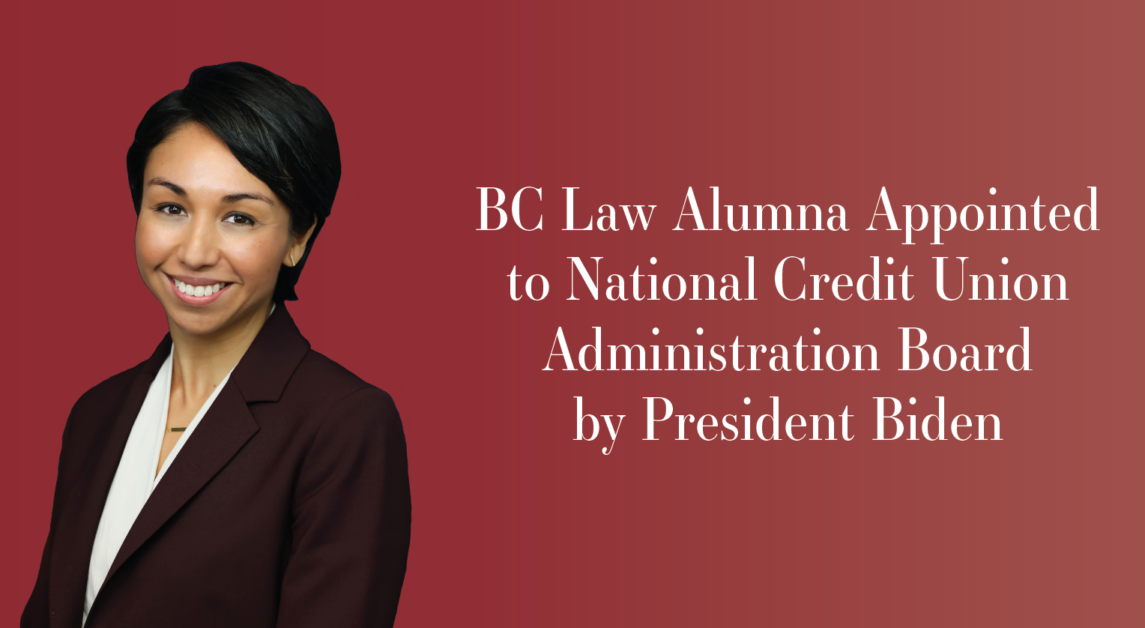

Tanya Otsuka, BC Law ’11, was sworn in as a board member of the National Credit Union Administration (NCUA) board on Jan. 8.

“I was very honored and humbled to be appointed to the NCUA board, nominated, and then confirmed—especially as somebody who’s a career public servant,” Otsuka said.

The NCUA is an independent federal agency that regulates and insures federal credit unions in the United States. The agency also seeks to raise awareness of fraud, increase access to affordable financial services, and educate consumers on financial matters, according to its website.

The NCUA’s board—comprised of a three-member panel that serves six-year staggered terms—sets policy for the agency, approves budgets, and adopts rules and regulations.

Otsuka—who was nominated by President Joe Biden in September and confirmed by a Senate vote on Dec. 20—said her primary goal is to ensure the federal credit system remains robust and secure.

“[My main goal] is to make sure that we have a safe, strong, or resilient credit union system—a credit union system that’s resilient to economic shocks. Otsuka said. “Part of that is making sure that consumers are protected and have access to the financial products and financial services that they need.”

Federal credit unions offer services similar to those provided by banks, such as making loans, accepting deposits, and providing credit cards. Unlike banks, however, credit unions are nonprofit organizations that are owned and governed by their members.

During her term, Otsuka said she hopes to bolster and support credit unions in areas that have traditionally faced discrimination or unequal access to resources.

“One of the focus areas that I’d like to concentrate on is making sure that small credit unions can continue to serve areas of the country that are often overlooked or underserved, whether that’s minority communities, small communities, certain urban communities,” Otsuka said. “Any community that needs financial services.”

No more than two members of the NCUA’s board can be from the same political party, which compels members to compromise and work productively despite political divisions, according to Otuska, who is a member of the Democratic party.

“So that gives the agency some independence, and also essentially forces or requires board members to be able to really try to work together,” Otsuka said. “And I think, so far, that has been the case.”

During her time at Boston College Law School, Otsuka participated in the Housing Law Clinic, Public Interest Law Foundation, and served as an article editor for the International and Comparative Law Review.

During this time, Otsuka published a note in the review analyzing Iran’s elections and the ways the country lacked compliance with international democratic standards—a topic that David Wirth, dean’s distinguished scholar at BC Law and advisor to the review at the time, said was particularly insightful.

“The topic on Iran’s elections, I would say, is very much ahead of its time,” Wirth said. “If you read the newspapers today, the comment stands out very well and is, if anything, quite prescient.”

Otsuka said she entered law school with the goal of working in public interest law, but a clerkship with the Federal Deposit Insurance Corporation (FDIC) opened her eyes to the chief importance of financial regulation and oversight—especially amid the aftershocks of the 2009 financial crisis.

“It’s not like I have a predisposition to [financial regulation], but that first job really introduced me to how important financial regulation can be to the lives of everyday people,” Otsuka said.

Upon graduating from BC Law, Otsuka returned to the FDIC for a full-time role and worked there for nine years. In March 2020, she accepted a position in Congress as counsel for the Senate Committee on Banking, Housing, and Urban Affairs, where she worked to pass legislation aiding workers and small businesses during the COVID-19 pandemic.

“There was a lot of uncertainty from a health perspective, of course, but also from a financial services perspective,” Otsuka said. “People wanted to make sure that they would still be able to access their money. Financial institutions wanted to be able to continue to serve their customers and there was a lot of concern about how the Coronavirus would impact all of those things.”

Wirth highlighted how BC alumni pursuing careers in public service like Otsuka embody the mission and values of a Jesuit education.

“It’s a pleasure to see our students go out and succeed so spectacularly,” Wirth said. “Especially contributing to the Jesuit ideal of men and women for others.”